Cover Letter

Cover Letter examples for top Debt Collection Manager jobs

Use the following guidelines and Cover Letter examples to choose the best Cover Letter format.

Debt Collection Manager Cover Letter Sample

About Debt Collection Manager Cover Letters

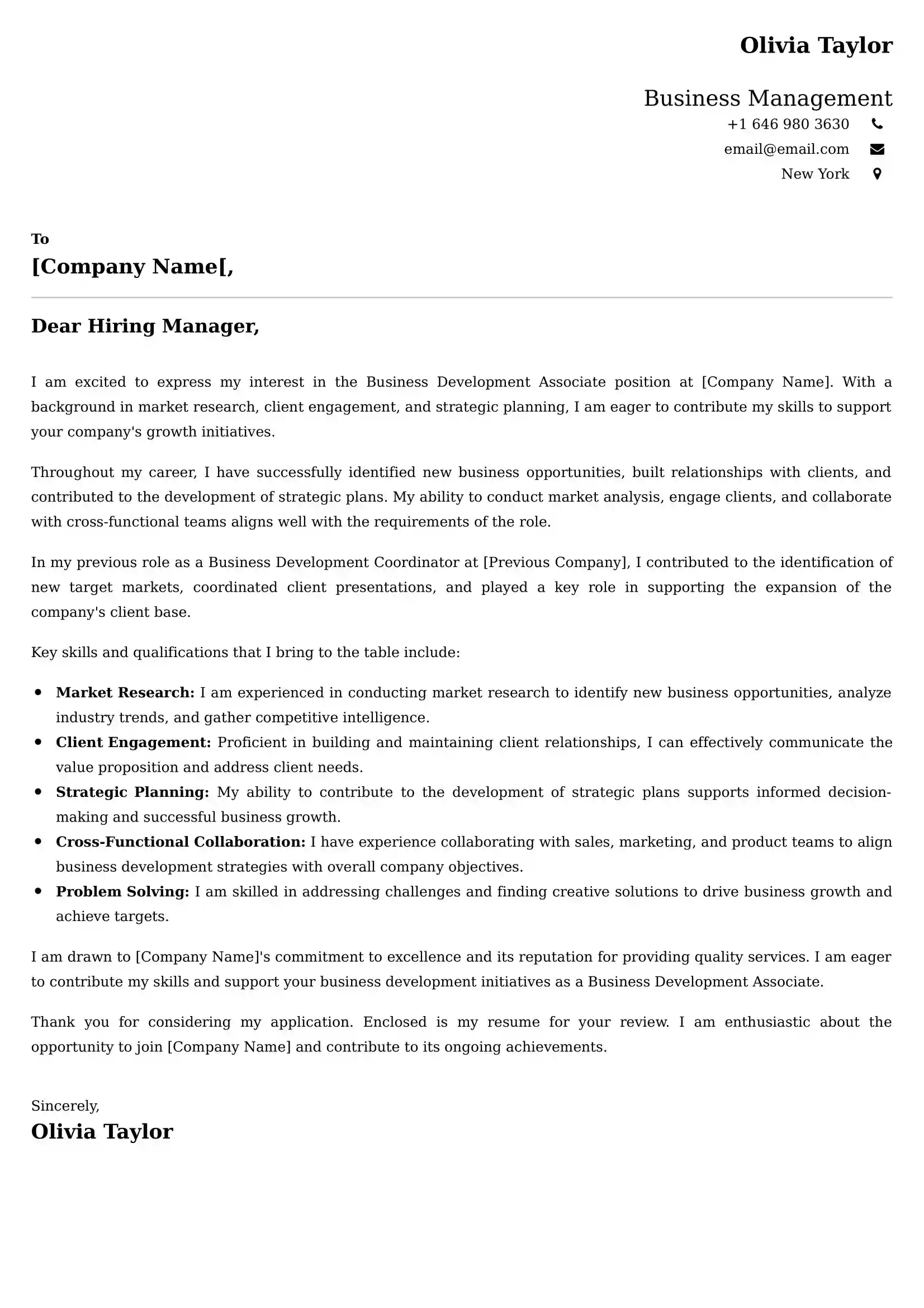

Welcome to our collection of Debt Collection Manager cover letter examples! Crafting a well-written cover letter is a crucial step in your job application process. A compelling cover letter can make a significant difference in grabbing the attention of potential employers and showcasing your qualifications. In this section, you will find a variety of cover letter samples tailored specifically for the role of a Debt Collection Manager.

Salary Details in INR

The salary for a Debt Collection Manager in India can vary depending on factors such as experience, location, and the organization. On average, Debt Collection Managers can expect to earn between INR 6,00,000 to INR 12,00,000 per year. However, these figures may differ, and it's important to research the specific salary range for your desired position and location.

Key Skills for Debt Collection Manager Cover Letters

When writing a cover letter for a Debt Collection Manager position, it's crucial to highlight your key skills and qualifications, which may include:

- Debt Recovery Expertise: Showcase your experience and success in debt recovery strategies.

- Team Leadership: Highlight your ability to lead and manage a team of debt collectors effectively.

- Negotiation Skills: Emphasize your negotiation skills in dealing with debtors and negotiating repayment terms.

- Regulatory Compliance: Mention your knowledge of debt collection laws and regulations.

- Communication: Stress your excellent communication skills, both written and verbal.

Job Scope and Growth for Debt Collection Managers

Debt Collection Managers play a pivotal role in managing and optimizing the debt recovery process for organizations. Their responsibilities include:

- Leading and supervising a team of debt collectors

- Developing and implementing debt recovery strategies

- Negotiating with debtors to recover outstanding payments

- Ensuring compliance with debt collection laws and regulations

- Reporting on debt collection performance to senior management

With experience and a proven track record, Debt Collection Managers can advance to higher-level positions in credit management or become Credit Managers, offering increased responsibilities and compensation.

FAQ's related to the Debt Collection Manager Role

- What qualifications are typically required to become a Debt Collection Manager?

- A bachelor's degree in finance or a related field, along with relevant experience, is often preferred.

- Is prior experience in debt collection necessary for this role?

- Yes, prior experience in debt collection or related roles is typically required to become a Debt Collection Manager.

- What software skills are essential for Debt Collection Managers?

- Proficiency in debt collection software and familiarity with customer relationship management (CRM) tools can be beneficial.

- How do Debt Collection Managers handle difficult debtors?

- Debt Collection Managers use their negotiation and communication skills to establish payment plans and resolve disputes amicably.

- What is the career path for Debt Collection Managers in the finance industry?

- Debt Collection Managers can progress to roles such as Credit Manager or Senior Credit Analyst with continued experience and professional development.

More Resume Examples for the Next Step in Your Debt Collection Manager Resume Career jobs

- Bookkeeper Resume

- Accounts Payable Clerk Resume

- Debt Collection Manager Resume

- Accounts Payable Manager Resume

- Night Auditor Resume

- Accounts Receivable Clerk Resume

- Payroll Analyst Resume

- Accounts Payable Receivable Manager Resume

- Payroll Manager Resume

- Accounts Payable Specialist Resume

- Collections Representative Resume

- Collections Team Lead Resume

- Accounts Payable Supervisor Resume

- Billing Specialist Resume

More Cover Examples for the Next Step in Your Debt Collection Manager Cover Career jobs

- Bookkeeper Cover Letter

- Accounts Payable Clerk Cover Letter

- Debt Collection Manager Cover Letter

- Accounts Payable Manager Cover Letter

- Night Auditor Cover Letter

- Accounts Receivable Clerk Cover Letter

- Payroll Analyst Cover Letter

- Accounts Payable Receivable Manager Cover Letter

- Payroll Manager Cover Letter

- Accounts Payable Specialist Cover Letter

- Collections Representative Cover Letter

- Collections Team Lead Cover Letter

- Accounts Payable Supervisor Cover Letter

- Billing Specialist Cover Letter

Get started with a winning Cover Letter template

750+ HR Approved Cover Letter Examples, Tested by Recruiters

Discover the ultimate resource for cover letter success with 750+ professionally crafted examples, thoroughly vetted by HR experts and recruiter tested. Elevate your job application game with confidence and secure your next opportunity. Your perfect cover letter is just a click away.

Cover Letter Examples

What clients say about us

Our Cover Letter Are Shortlisted By